Updated 4.23.2021 Updated launch date: The SBA announced that is has completed rigorous testing and the Shuttered Venue Operators Grant application portal and it will reopen on Monday,...

The Restaurant Revitalization Fund

Updated 4-6-2021 The American Rescue Plan Act of 2021 (the “Act”), signed by President Biden on March 11, 2021, includes within Section 5003 a $28.6 billion appropriation to establish a...

PPP Application Deadline Extended

On Wednesday, March 31, 2021, the President signed the PPP Extension Act of 2021, H.R. 1799 which moves the Paycheck Protection Program (PPP) application deadline from March 31 to May 31. ...

Economic Injury Disaster Loans Update

The U.S. Small Business Administration is more than tripling the maximum amount that small businesses and nonprofits can borrow under the COVID-19 Economic Injury Disaster Loans (EIDL)...

What’s in the ARPA for individuals?

On March 11, 2021, President Biden signed the American Rescue Plan Act (“the Act”), a $1.9 trillion COVID-19-relief stimulus package. The Act extends the unemployment benefits that were...

New stimulus business and nonprofit benefits

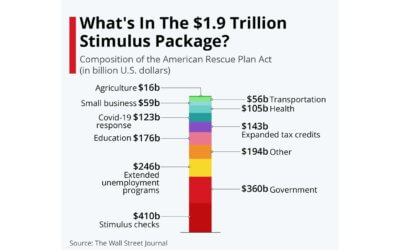

President Biden has signed into law The American Rescue Plan Act 2021 (ARPA), which includes $1.9 trillion in funding for individuals, businesses, and state and local governments. The...

Is your business eligible for the employee retention tax credit?

UPDATED March 15, 2021 to reflect additional guidance and the ARPA Act of 2021 Under the Consolidated Appropriations Act, 2021, the employee retention credit, a provision of the CARES Act,...

The American Rescue Plan Act: What’s in it for you?

President Biden has signed into law the 628-page The American Rescue Plan Act 2021 (ARPA), which includes $1.9 trillion in funding for individuals, businesses, and state and local...

New favorable PPP rules for self-employed

The U.S. Small Business Administration (SBA) issued new Paycheck Protection Program (PPP) rules that allow self-employed individuals who file Form 1040, Schedule C, Profit or Loss From...