W&D has compiled a list of resources to help business owners, management and individuals navigate the ongoing Covid-19 pandemic. This area is updated regularly.

Search COVID-19 Resources

E-Alert Sign-Up

ERC

COVID-19 EIDL Loans

The U.S. Small Business Administration (SBA) expanded eligibility for COVID-19 Economic Injury Disaster Loan (EIDL) funding.in September, 2021. While you may not have qualified or considered EIDL funding necessary previously, you might want to reconsider. But you’ll...

Important Employee Retention Credit Changes

Employee Retention Credit Early Termination The employee retention credit will be terminated early and broker reporting of cryptoasset transfers will be required as a result of legislation (H.R. 3684) that passed the House of Representatives late Friday and is headed...

Related On-Demand Webinars

Additional Information

Employee Retention Tax Credit

- Employee Retention Credit: Is Your Business Missing Out? April 24, 2021

- Is Your Business Eligible for the Employee Retention Tax Credit? March 15, 2021

PPP Forgiveness

PPP first-draw forgiveness & repayment

The end of the principal and interest payment deferral period is rapidly approaching for many businesses that received first-draw loans under the Paycheck Protection Program (PPP1). To avoid having to make payments, if you have not filed for your PPP1 forgiveness,...

New stimulus business and nonprofit benefits

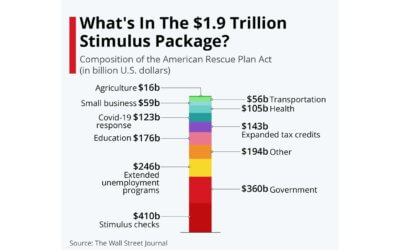

President Biden has signed into law The American Rescue Plan Act 2021 (ARPA), which includes $1.9 trillion in funding for individuals, businesses, and state and local governments. The latest stimulus package contains benefits for businesses and nonprofits. It...

Related PPP On-Demand Webinars

Paycheck Protection Program SBA Resources

Revised PPP Loan Forgiveness Forms

- SBA Form 3508 Paycheck Protection Program Loan Forgiveness Application (updated 01-19-21)

- SBA Form 3508EZ Paycheck Protection Program Loan Forgiveness Application (updated 01-19-21)

- SBA Form 3508S Paycheck Protection Program Forgiveness Application (updated 01-19-21)

- Loan Forgiveness Requirements and Loan Review Procedures as Amended by Economic Aid Act

Other SBA Programs & Grants

Shuttered Venue Operator Grants

- Shuttered Venue Operator Grants Program Reopens April 26, 12 PM ET. UPDATED: 4.25.2021

Restaurant Revitalization Fund

- The Restaurant Revitalization Fund Ready to Launch. 4.25.2021

- The Restaurant Revitalization Fund. UPDATED: 4.8.2021

Tax Legislation

2021 year-end tax planning for individuals

Potential tax law changes and year-end tax planning for individuals As if another year of the COVID-19 pandemic wasn’t enough to produce an unusual landscape for year-end tax planning, Congress continues to negotiate the budget reconciliation bill. The proposed Build...

2021 business year-end tax planning

Businesses must navigate 2021 year-end tax planning with new tax laws potentially on the horizon The end of the tax year is fast approaching for many businesses, but their ability to engage in traditional year-end planning may be hampered by the specter of...

Additional Helpful Resources

Financial Resources and Loan Assistance

We have compiled a comprehensive, summarized list of COVID-19 emergency business loan assistance and disaster relief assistance at the Federal, State and City level. VIEW HERE.

Loan & Disaster Relief Programs

- NEW: EIDL Program Updates

- SBA PPP Loan Forgiveness Application & Instructions

- Federal Reserve’s Main Street Lending Program Update

- Illinois COVID-19 Relief Programs Update

- SBA Provides PPP Maximum Loan Calculation Formulas by Business Type

- The US Department of the Treasury Issues Guidance on Paycheck Protection Program Including How to Apply

- Q&A for CARES Act Emergency Loans – Apply Now

- CARES Act Small Business Emergency Loans

- Illinois Department of Commerce Emergency Small Business Grants and Loans Assistance

- Disaster Assistance Loans from the Small Business Administration – SBA

- City of Chicago offering small business loan program – Chicago Small Business Resiliency Fund

Lay-offs and Business Continuity Planning

- UPDATED WITH DOL GUIDANCE 3.26.2020: COVID-19 Employee Lay-Off Questions & Answers

- Business Continuity Planning (Provided by AON)

State Level Assistance

Since each state’s plan to assist businesses varies, the best thing business owners can do is check with their local governor’s office for the latest on state specific assistance, resources and updates. You can also check in with local small business organizations and agencies. Here is a list of state- and local-level small business resources to consult:

Resources for Employers

Unemployment

- Illinois Emergency Unemployment Benefits for workers who unemployment is attributable to COVID-19 – IDES

- How to apply for Illinois unemployment

Responding to Coronavirus

- Guidance for Employers to Plan and Respond to Coronavirus Disease – CDC

- Coronavirus Q&A for Employers – MRA

- Coronavirus Disease (COVID-19): What You Should Know – CDC

- US Chamber of Congress Coronavirus Response Tool Kit – UCC

Preparing Workplaces for Coronavirus (COVID-19)

- Compensation Guidelines During the Coronavirus Pandemic – MRA

- COVID-19: Wage and Hour Questions and Answers – DOL

- Guidance on Preparing Workplaces for COVID-19 – OSHA

- Plan Now for Coronavirus to Avoid Disruptions and Promote Safe Practices – CCH Wolters Kluwer

- Our People – Resources for Employees (Link to Convergence Coaching Coronavirus Resource Center)

Midwest State Health Resources

- Illinois Department of Public Health

- Iowa Department of Public Health

- Wisconsin Department of Health Services

- Minnesota Department of Health

Legal Notice: The materials communicated in this transmission are for informational purposes only and not for the purpose of providing accounting, legal or investment advice. You should contact your accountant or advisor to obtain advice with respect to any particular issue or problem. Use of and access to this Web site or any of the e-mail links contained within the site do not create an accountant-client relationship between Warady & Davis and the user or browser. You should not act upon any such information without first seeking qualified professional counsel on your specific matter. Any accounting, business or tax advice contained in this communication is not a substitute for a formal opinion, nor is it sufficient to avoid tax-related penalties. If desired, Warady & Davis would be pleased to perform the requisite research and provide you with a detailed written analysis. Such an engagement may be the subject of a separate engagement letter that would define the scope and limits of the desired consultation services. © 2021 All Rights Reserved.

The Idea Exchange Blog

COVID-19 EIDL Loans

The U.S. Small Business Administration (SBA) expanded eligibility for COVID-19 Economic Injury Disaster Loan (EIDL) funding.in September, 2021. While you may not have qualified or...

Important Employee Retention Credit Changes

Employee Retention Credit Early Termination The employee retention credit will be terminated early and broker reporting of cryptoasset transfers will be required as a result of legislation...

Update: COVID Economic Injury Disaster Loan Program

The rapid spread of the Delta variant of COVID-19 has mired a variety of companies in diminished revenue and serious staffing shortages. In response, the Small Business Administration...

Learn more.

Subscribe to our newsletter and receive access to industry best practices, tips and more.