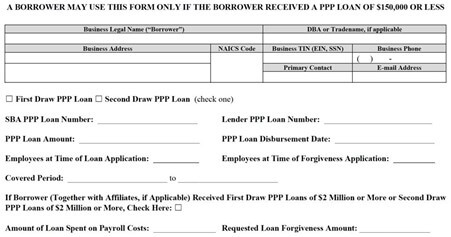

The US Small Business Administration (SBA) and Treasury have published updated Paycheck Protection Program (PPP) loan forgiveness guidance and forms, including a one-page application for borrowers that received a PPP loan of $150,000 or less – Form 3508S. Before the program reopened, that threshold covered about 4.6 million of the program’s total 5.2 million loans.

The new forgiveness application makes PPP even more attractive to qualifying businesses by streamlining the process for getting loans forgiven. Following is an in-depth look at the new app.

Form 3508EZ and Form 3508 are also now updated to reflect recent guidance and changes under the The Economic Aid to Hard-Hit Small Businesses, Nonprofits, and Venues Act, P.L. 116-260 “Economic Aid Act,” part of the Consolidated Appropriations Act of 2021.

Identifying Information

At only one page in length, the 3508S form is shorter and easier to complete. Significantly, it no longer requires borrowers to show the calculations you use to determine how much of your loan should be forgiven.

NAICS 72 Borrowers (Hospitality Industry)

The first section asks for identifying information, including, for the first time, your NAICS code (or industry classification). This is especially important for borrowers with code beginning with 72 — that’s restaurants, hotels, food service and hospitality. For companies in these industries, the maximum loan amount is 3.5 times average monthly payroll, rather than 2.5 times average monthly payroll.

EIDL Advance

There’s one other significant change. The application no longer requires information from your Economic Injury Disaster Loan (EIDL) advance. These funds were originally supposed to offset your forgiveness amount but no longer do so.

Other requested information, includes:

- SBA PPP Loan Number (the loan number assigned by the SBA at the time of approval)

- Lender PPP Loan Number (the loan number assigned to the PPP Loan by your lender)

- PPP Loan amount

- PPP Loan disbursement date

- Employees at the time of loan application

- Employees at the time of forgiveness of the application

- The covered period (this is the eight- to 24-week period following the disbursement of the loan)

- Amount of Loan Spent on Payroll Costs

- Requested Loan Forgiveness amount

IMPORTANT NOTE: Borrowers still must meet all forgiveness requirements.

The Certifications

Next are two certifications.

The first certifies that you complied with all PPP rules, including:

- Eligible uses of PPP loan proceeds (remember this list was recently expanded)

- The amount of PPP loan proceeds that must be used for payroll (at least 60% of the requested loan forgiveness amount)

- The calculation and documentation of your revenue reduction (if applicable), and

- The calculation of your loan forgiveness amount.

While you are certifying that you complied with all requirements, you don’t have to show the supporting numbers.

The second certification is that the information you provide is true and correct “in all material aspects.” Knowingly making a false statement could result in up to five years in prison and/or a fine up to $250,000. If you deceive a federally insured institution, that increases to up to 30 years and or a fine of not more than $1,000,000.

After you completed those steps, you sign and print your name, date it and you’re ready to apply through your lender’s portal.

Important Considerations

The new application is significantly simpler, but there are still several things to keep in mind.

Documentation Requirements

You must retain your records to prove compliance for four years for employment records and three years for other records. Additionally, the SBA can ask for additional documentation if necessary.

Demographic Questions

While optional, the SBA states that it is important to answer the form’s demographic questions, so that they can track PPP’s impact on minority business owners. This information can go a long way in making sure the people who need the funds the most are receiving what they need.

Lender’s Portal

While the SBA provides this template, your lender will likely create its own electronic version of the form for the application. Use the SBA document as a working draft to have on hand when completing the application process through your lender’s portal.

Covered Period Changes

Due to the Consolidated Appropriations Act, 2021, your covered period can be anywhere from eight TO 24 weeks (in the past you could only choose 8 OR 24 weeks). Most borrowers will opt to take the longest covered period so that they have more time to spend the money on covered expenses.

Employee Retention Tax Credit

Also remember that you can now use PPP in conjunction with the Employer Retention Credit (ERC), but you must use different qualifying wages for each. In short, make sure you are keeping track of which wages you’ve used for PPP forgiveness and which wages you’d like to use for the ERC. And as with the former forgiveness applications, for each individual employee, the total amount of cash compensation eligible for forgiveness may not exceed the annual salary of $100,000 annualized for the covered period.

If you are not eligible for the 3508S form, you need to use the Form 3508 or 3508EZ, both of which have also been updated to reflect changes under the Economic Aid At 2021.

This is a large step forward in making the forgiveness process easier for many borrowers.

Questions?

Contact your Warady & Davis advisor or our PPP team at 847-267-9600; info@waradydavis.com. You can also visit the Warady & Davis LLP COVID-19 Resource Center for a wealth of information on stimulus assistance, new legislation and much more. This information is updated regularly.

SOURCE: SBA, U.S. Treasury, IRS and AICPA

This information is changing rapidly and is based on our current understanding of the programs. It can and likely will change. Although we will be monitoring and updating this as new information becomes available, please do not rely solely on this for your financial decisions. We encourage you to consult with your lawyers, CPAs and Financial Advisors.

Legal Notice: The materials communicated in this transmission are for informational purposes only and not for the purpose of providing accounting, legal or investment advice. You should contact your accountant or advisor to obtain advice with respect to any particular issue or problem. Use of and access to this Web site or any of the e-mail links contained within the site do not create an accountant-client relationship between Warady & Davis and the user or browser. You should not act upon any such information without first seeking qualified professional counsel on your specific matter. Any accounting, business or tax advice contained in this communication is not a substitute for a formal opinion, nor is it sufficient to avoid tax-related penalties. If desired, Warady & Davis would be pleased to perform the requisite research and provide you with a detailed written analysis. Such an engagement may be the subject of a separate engagement letter that would define the scope and limits of the desired consultation services. © 2021 All Rights Reserved